NASDAQ-100 成份股替換,你該買嗎?

Nasdaq於2021/12/10宣佈NASDAQ-100指數年度成份股調整名單,生效日於2021/12/20開始。新加入的6家公司分別為Airbnb (ABNB), Fortinet (FTNT), Palo Alto Networks (PANW), Lucid (LCID), Zscaler (ZS), Datadog (DDOG). 這些都是最近股價走勢相當不錯的公司。如果投資人在看到這些消息後,在2021/12/13開盤買入是否會有獲利的機會呢?

我們可以先把過去幾年,自Nasdaq宣佈成份股替換後,新加入指數的公司與QQQ的股價績效做比對,來看看股價是否有明顯的突出。

歷年Nasdaq成份股替換資料

Dec. 11, 2020 : American Electric Power Company, Inc. (Nasdaq: AEP), Marvell Technology Group Ltd. (Nasdaq: MRVL), Match Group, Inc. (Nasdaq: MTCH), Okta, Inc. (Nasdaq: OKTA), Peloton Interactive, Inc. (Nasdaq: PTON), Atlassian Corporation Plc (Nasdaq: TEAM).

Dec. 13, 2019 : ANSYS, Inc. (Nasdaq: ANSS), CDW Corporation (Nasdaq: CDW), Copart, Inc. (Nasdaq: CPRT), CoStar Group, Inc. (Nasdaq: CSGP), Seattle Genetics, Inc. (Nasdaq: SGEN), Splunk Inc. (Nasdaq: SPLK).

Dec. 14, 2018 : Advanced Micro Devices, Inc. (Nasdaq: AMD), lululemon athletica inc. (Nasdaq: LULU), NetApp, Inc. (Nasdaq: NTAP), United Continental Holdings, Inc. (Nasdaq: UAL), VeriSign, Inc. (Nasdaq: VRSN) and Willis Towers Watson Public Limited Company (Nasdaq: WLTW).

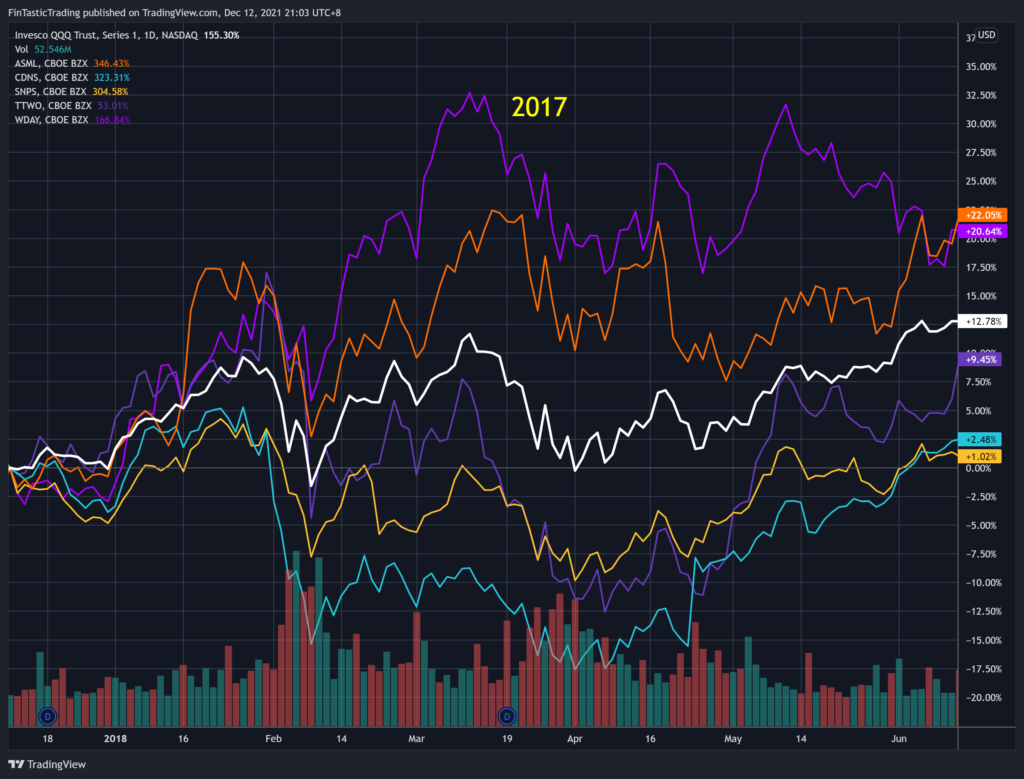

Dec. 08, 2017 : ASML Holding N.V. (Nasdaq:ASML), Cadence Design Systems, Inc. (Nasdaq:CDNS), Synopsys, Inc. (Nasdaq:SNPS), Take-Two Interactive Software, Inc. (Nasdaq:TTWO) and Workday, Inc. (Nasdaq:WDAY).

Dec. 09, 2016 : Cintas Corporation (Nasdaq:CTAS), Hasbro, Inc. (Nasdaq:HAS), Hologic, Inc. (Nasdaq:HOLX), KLA-Tencor Corporation (Nasdaq:KLAC).

從過去2016~2020年的成份股更換經驗,新加入NASDAQ-100指數的股票,在宣佈後的六個月,沒有明顯因被動管理基金買入而漲幅明顯高於大盤。這與我們一般的直覺並不相同。或許我們可以再進一步了解nasdaq是如何選擇成份股的。

Nasdaq-100成份入選條件

依照Nasdaq官方說明,該指數是挑選在Nasdaq上市、市值排序最高、非金融類(不含REITs)、平均交易量>200K股的股票。而挑選的日期以每年10月底的數字計算,股權總數以11月底數字計算,12月初公布名單。

Constituent selection process

A Reconstitution is conducted on an annual basis, at which time all eligible Issuers, ranked by market capitalization, are considered for Index inclusion based on the following order of criteria.

- The top 75 ranked Issuers will be selected for inclusion in the Index.

- Any other Issuers that were already members of the Index as of the Reconstitution reference

date and are ranked within the top 100 are also selected for inclusion in the Index. - In the event that fewer than 100 issuers pass the first two criteria, the remaining positions will

first be filled, in rank order, by issuers currently in the index ranked in positions 101-125 that

were ranked in the top 100 at the previous Reconstitution or replacement-or spin-off-issuers

added since the previous Reconstitution. - In the event that fewer than 100 issuers pass the first three criteria, the remaining positions will be filled, in rank order, by any issuers ranked in the top 100 that were not already members of the Index as of the Reference Date.

仔細了解以上的規則之後可以發現,成份股的更換在10月底時,就可以大概知道有那些了。也就是Market Cap排序已經在前75且還不在Index裡的,確定會入選。Market Cap在76~100且還不在Index裡的,可能會入選。股價在10月底確定,雖然股票數在11月底確認,但是股數的變動是事先知道的,所以10月底就可以算出NASDAQ-100成份股”新進名單”了。尤其法人更不可能在消息當天才反應。那11月初會是布局的最佳時機嗎?

新增名單10月平均上漲9.38%

根據2018年Brock University的一份研究 – Impact of Changes in the Nasdaq 100 Index Membership。從1997~2015的128檔新加入指數的公司股價表現中,股價增幅最多的是10月份,平均上漲9.38%。11月份反而會下跌0.64%,從12月初到正式公佈則會上漲3.19%。

根據這份資料數據顯示,投資人仍然不能透過在11月提早預測新進指數名單進行提早佈局來獲利! 這些新進入指數的公司多半是在10月份就大漲10%。或是更早之前就大漲,可能是Q2、Q3的季報表現不錯,股價大漲後進入Market Cap排序前75,就篤定入選。所以因果關係是與我們之前的假設顛倒的。

- 錯誤假設 – 股票因為入選NASDAQ-100導致大漲

- 正確解讀 – 股票因為大漲,導致入選NASDAQ-100

我們在將今年入選的6檔股票K線圖攤開來看。若採用今日的Market Cap排行,第75名50B, 第100名34.7B。我們可以發現,ABNB今年市值都在80B以上,是早就篤定入選。DDOG股價自從5月低點$70到9月底就已經翻倍到$140,10月沒有特別消息情況下,有出量拉了18%,超過50B篤定入選。FTNT股價在8月財報不錯,就達到50B的篤定入選,10月再上漲15%。PANW今年以來一直都在可能入選名單,8月大漲後非常接近50B的篤定入選,10底上漲6.3%幾乎篤定入選。LCID則是波動劇烈,一直到10/28一天大漲31%才進入可能入選名單。炒作意味濃厚。ZS從5月低點160大漲到9月底$260,進入可能名單,10月份繼續大漲21.45%,最後才確定進入。

反向操作?!

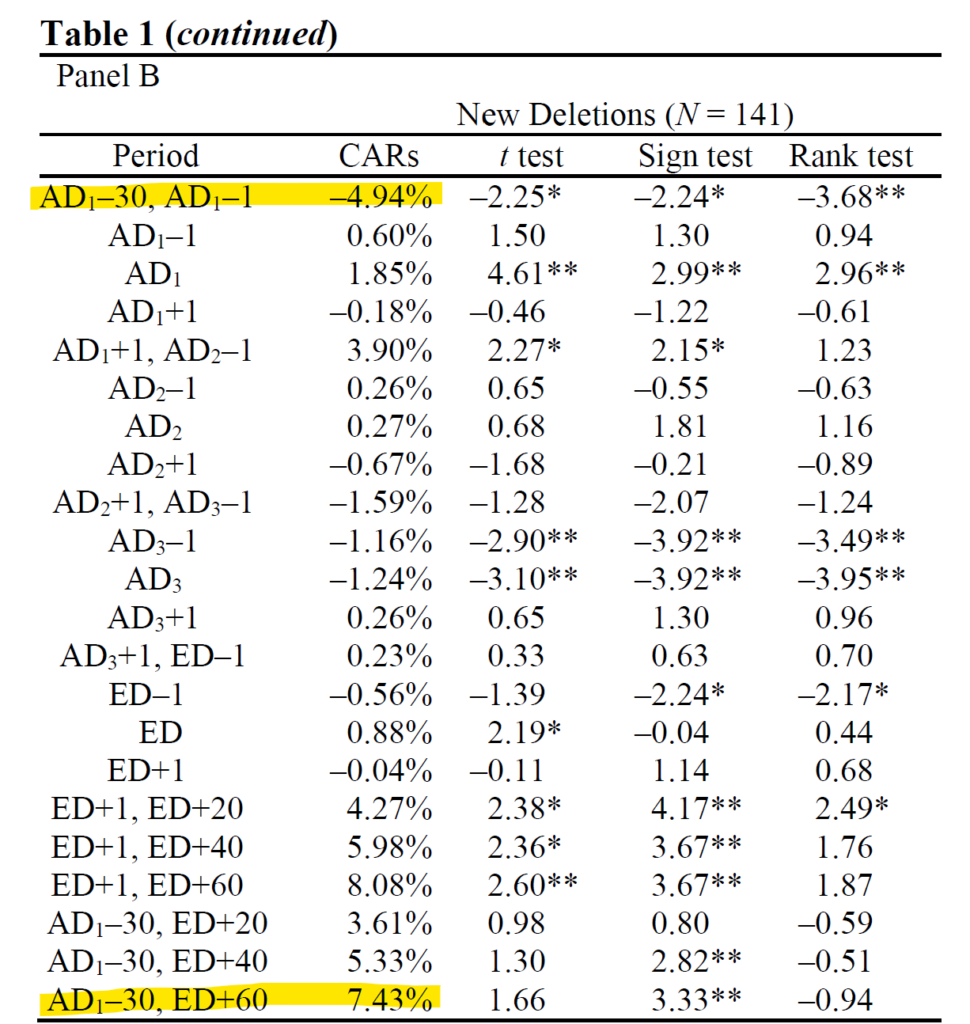

若計算新聞公佈(AD3)到生效日後60天,新增加公司的平均收益16.24%-9.38%-0.68%+0.64%-0.74%-3.19% = 2.89%。相反的若計算從指數刷下來的公司,依照過去141個股票案例,平均收益是7.43%-(-4.94%)-1.85%-3.9%-0.27-(-1.59%) = 7.94%。竟然收益高出了1.7倍。換句話說,當股票被指數刷下來,很可能只是因為市值排名本來就在末10名,而有些新上市,或是突然暴衝的公司把他們擠出榜外。若他們季報表現並沒有不好,而短暫的下跌可能是好的進場點!

此次從NASDAQ-100刪除的成份股為:CDW Corporation (Nasdaq: CDW), Fox Corporation (Nasdaq: FOXA/FOX), Cerner Corporation (Nasdaq: CERN), Check Point Software Technologies Ltd. (Nasdaq: CHKP), Trip.com Group Limited (Nasdaq: TCOM), Incyte Corporation (Nasdaq: INCY)。或許這些股東也不用太擔心,從歷史來看,這些股票從明天(12/13/2021)到生效日(12/20/2021)後的60天,平均會有7.94%的股價上漲幅度。